14. November 2019

UK taxes for dummies, a visual approach

In the UK, I was recently asked by someone how much money would remain from their income after taxes. While I could give a pretty good estimate, I discovered I had actually no idea how the net income is actually computed. None of the documentation I found was easy to understand. However, I can read maths. And I can look at pictures. So here’s a visual approach to a net income calculator for the UK, for dummies like me.

In the UK, I was recently asked by someone how much money would remain from their income after taxes. While I could give a pretty good estimate, I discovered I had actually no idea how the net income is actually computed. None of the documentation I found was easy to understand. However, I can read maths. And I can look at pictures. So here’s a visual approach to a net income calculator for the UK, for dummies like me.

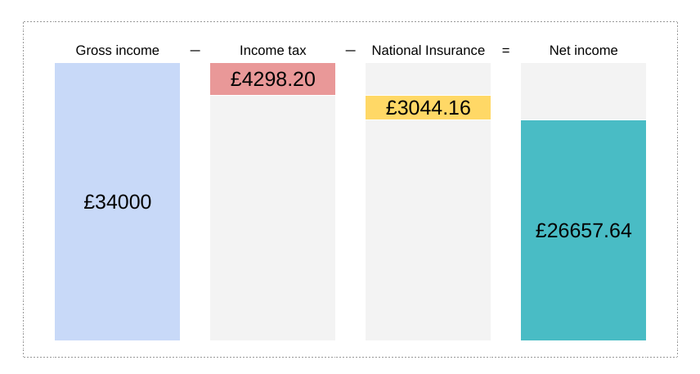

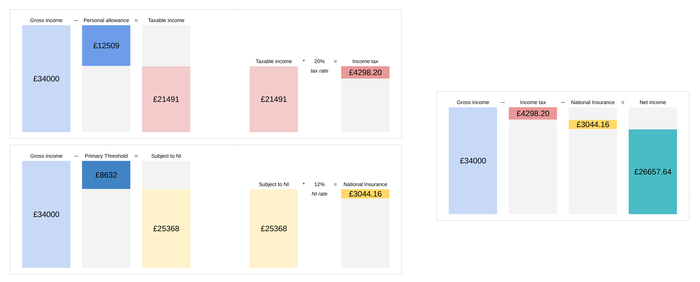

After a bit of trial-and-error I have figured out that the following model must be correct in tax year 2019/2020 for anyone with a gross income of £34000 (employed, not self-employed), a salary I have chosen for demonstratory purposes─it is close to to the median salary in London). You can verify my calculations with the tax calculator provided by HMRC. Here is how you calculate the net income from gross income by subtracting the National Insurance contributions and the income tax from the gross income:

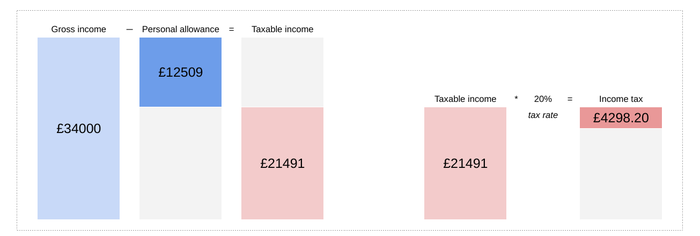

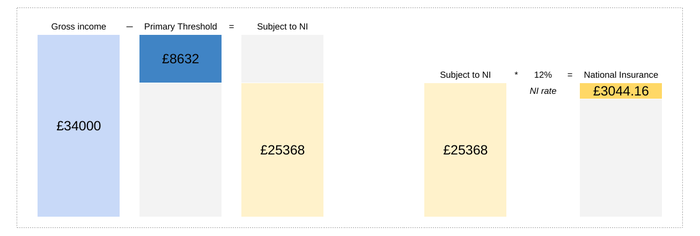

In order to calculate the net income (within the tax band applying to gross income of £34000), we thus need to calculate both income tax and National Insurance contributions. To do that we need the following four quantities: the personal allowance (£12509), income tax rate (20%), the primary threshold (£8632), the National Insurance rate (12%). We can find all four quantities on the HRMC website─although I used the tax calculator to figure out which primary threshold applies (here Class 1 National Insurance rates).

And here is how to calculate the income tax (full image):

And here is how to calculate the National Insurance contributions (full image):

And here is how the whole thing fits together (full image):

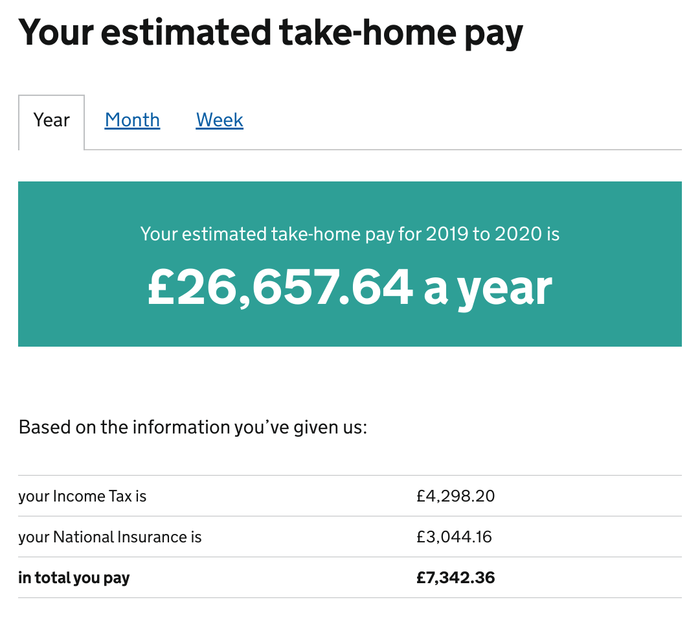

Okay, that’s it. The many significant digits are misleading─it’s an estimate. Compare this to the output of the tax calculator:

You have just read a random post on the Internet that explains UK taxes for you. Trust it at your own peril. I am not going to take responsibility for any mistakes or oversimplifications. But I have done my best.